Did you know that retailers are creating their own disastrous race to the bottom, even though customers are willing to pay more?

?Since January, retailers have steadily reduced their prices 4.5%

?What they didn’t realise was that consumers’ price tolerance has actually increased 7%

⛈️ And in Europe, retailers’ pricing is trending to go below what customers would expect, undermining their brand and place in the market and creating an incredibly dangerous precedent for how they are perceived.

How did we discover this?

We analysed the 25,000 automated, 1-1 negotiation chats that the hundreds of retailers using Nibble around the world have with their customers every month, to expose consumers’ current and changing behaviour, expectations and tolerances – and then compared that to retailers’ actions.

This is one-of-a-kind data. No one else has such insights into customers’ raw and unfiltered reactions to ecommerce pricing at the point of sale.

But you can have it for free.

In our Table Talk series – pricing insights sessions, presented by our co-founder Rosie Bailey – we present these insights to senior ecommerce leaders for them to incorporate into their own promotional strategies.

Let’s take a closer look at the nightmare scenario we discovered in April’s data, supported with clips from this month’s Table Talk presentation…

How retailers are setting their pricing

In December 2022, the 300+ retailers around the world using Nibble were willing to accept an average negotiated discount of anything up to 11% off full price. This was their ‘walkaway’ price.

This means that in every negotiation, Nibble would seek to draw a consumer’s price up above 11% discount (on average), and push them as high above it as possible without risking losing the deal.

In this sense, 11% off full price was retailers’ average pain threshold in December.

In January 2022, this pain threshold dropped lower. Retailers put their pricing up 9% in a single month by reducing the average discount they were willing to bear to only 10%.

In the Table Talk session, Rosie called this “The Finance Director Theory”. After a tough 2022 where profitability was tough to achieve, global business sentiment changed and “sustained profitable growth” became the new imperative. And so, discounts had to reduce.

But then reality hit. Sales targets became harder to hit and anxiety set in. So every month from then on, discounts have steadily increased.

And now in April, average discounts are trending to be approximately 14% off full price – lower than December, and even lower than November and Black Friday / Cyber Monday.

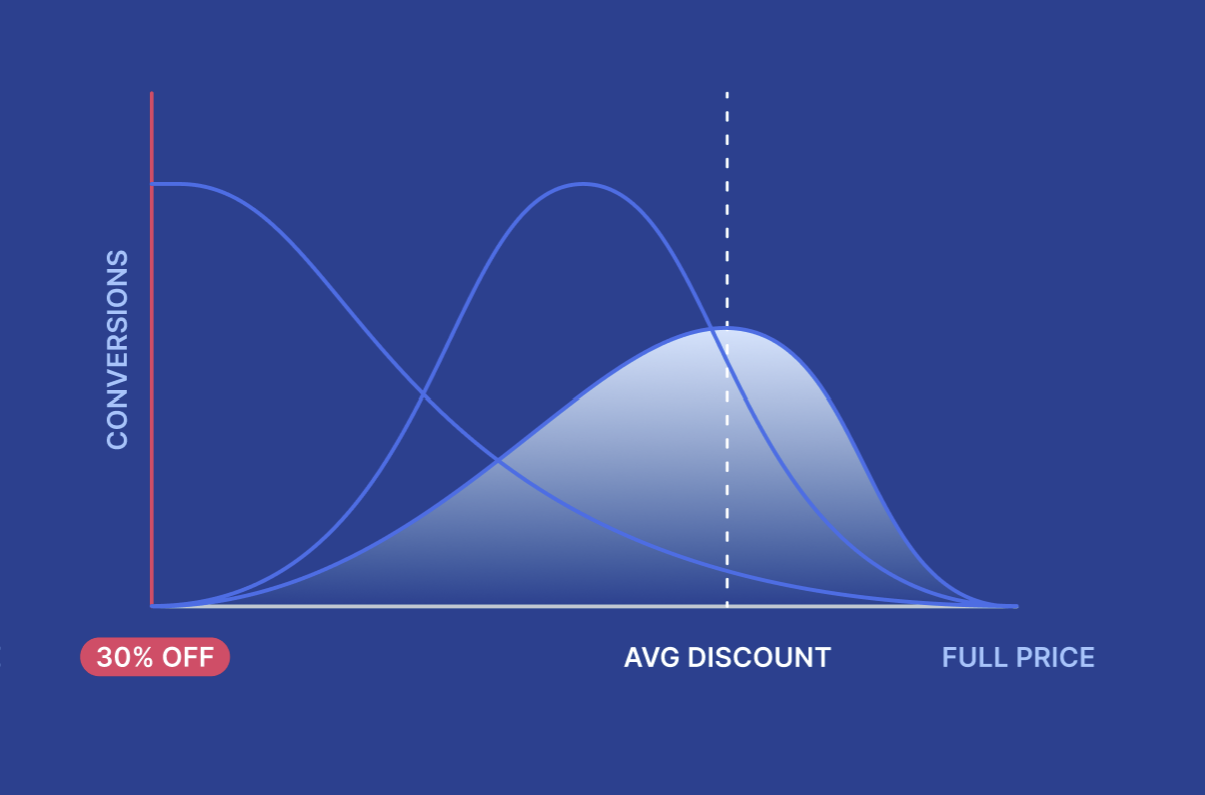

But what pricing do consumers actually expect?

This inability to set pricing to support profitability goals would be bad enough on its own.

But when put in the context of the pricing customers expect to see – point-of-purchase data that only Nibble has – the story is even worse.

When retailers increased their pricing in January, they did so at the exact same moment when consumers’ pricing expectations dropped. From expecting to pay 26% less than full price (based on their initial offers in Nibble negotiation chats), this expectation suddenly fell to nearly 30% off.

Unsurprisingly, the disparity between retailers’ high prices and consumers’ low expectation caused poor ecommerce performances in January, leading to retailers “blinking first” and responding with lower prices and bigger discounts month on month.

But what they haven’t realised since is that consumers’ price sensitivity has worn off. The price they are willing to pay increased slightly in February, massively in March and is trending to increase further still this month.

And when you look at the geographical breakdowns, our European retailers are trending to offer discounts below what their customers expect to see.

Here’s the main lesson to learn:

Greater discounts might lead to better conversion rates and more revenue, but they needlessly sacrifice margin by typically giving away far more margin than is necessary to win the deal. And they totally undermine any brand status these retailers may have spent years cultivating.

What does this mean?

Retailers are racing to the bottom, and they don’t need to.

Retailers do not need to come down to consumers’ price expectations to win deals. By negotiating 1-1 instead of offering generic site-wide discounts, retailers can actually earn far better priced deals, and meet their profitability goals.

In other words, while retailers using Nibble may have fallen into the same trap as everyone else and dropped their prices when they didn’t need to, using AI negotiation will save them from sacrificing more than necessary – giving them a crucial competitive advantage.

Really?

Absolutely. Just look at the deal values we were able to achieve in April for some of our key sectors, compared to their lowest tolerable discounts (aka what they would have given away with a voucher code)…

What Next?

Sign up for the next Table Talk for the next round of pricing and promotion insights.

Or, to get Nibble on your own website, or schedule a free demo call to find out more, contact us here.

Interested in Nibble?